Deep Expertise in FinTech & Compliance

We understand data security, digital payment, and financial regulations norms, ensuring every solution is RBI, PCI-DSS, and ISO-compliant.

FinTech companies are reshaping how people borrow, pay, invest, and manage money. But behind every successful FinTech product lies secure, scalable, and user-friendly technology that customers can trust. We specialize in custom FinTech solutions that combine innovation, compliance, and seamless user experiences. We design and develop tailored financial platforms—not generic software—ensuring your product meets regulatory standards and scales with user demand.

Years of Experience

Successful Projects

Digital Payment Solutions

We build custom payment gateways, UPI-enabled apps, and QR-based solutions for seamless transactions. Our platforms ensure fast, secure, and RBI/PCI-DSS compliant digital payments.

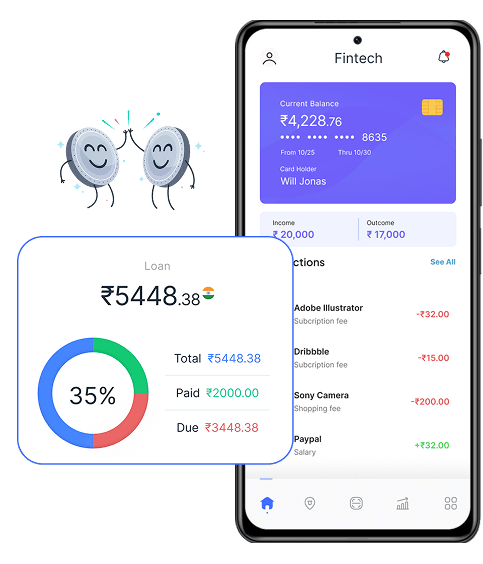

Mobile Banking & Wallet Apps

We create branded mobile banking apps and digital wallets for customers to manage accounts, payments, and transfers. Our apps provide a smooth user experience with biometric security and real-time updates.

Digital Lending Platforms

We design custom loan origination and management systems for instant lending and credit scoring. Our solutions support KYC, credit bureau checks, and automated EMI tracking.

API Banking & FinTech Integrations

We integrate with Aadhaar, UPI, Bharat BillPay, and payment APIs to build scalable banking-as-a-service platforms. Our API-based solutions enable faster go-to-market for fintech startups.

WealthTech & Investment Platforms

We develop mutual fund apps, trading platforms, robo-advisory tools, and portfolio management systems. Our platforms are secure, data-driven, and built for scalable investments.

Cloud-Based Financial Infrastructure

We deploy FinTech platforms on AWS and Azure with CI/CD pipelines for scalability and high availability. Our infrastructure supports millions of users with 99.9% uptime.

We understand data security, digital payment, and financial regulations norms, ensuring every solution is RBI, PCI-DSS, and ISO-compliant.

We don’t sell generic software—we design solutions around your business model, making them scalable, API-driven, and user-friendly.

With bank-grade encryption, secure APIs, and role-based permissions, our solutions guarantee data privacy and fraud prevention.

We’ve delivered lending platforms, payment apps, and API-based ecosystems that scaled to millions of users and transactions.

From UI/UX design, core development, API integrations, cloud deployment to AMC, we handle everything under one roof.

We provide maintenance, upgrades, and cloud monitoring to ensure your platform scales as your user base grows.

Whether you’re building a digital lending platform, payment app, wallet, or investment tool, the choice of your technology partner can define your success. We build secure, compliant, and user-friendly solutions that scale to millions of transactions.

Get Free Consultation

Custom Digital Lending Platform

Mobile Wallet & UPI App

API Banking Platform

Payment Gateway Integration

Wealth Management App

Digital Insurance Portal

Loan Origination System for MSMEs

Financial Aggregator Website

Cloud Migration for FinTech Startup

Compliance & Reporting Dashboard

Our approach starts with deep analysis of your processes, followed by building platforms that fit your workflow, not the other way around.

1

2

3

4

5

6

Building a digital payment app or lending platform? We craft secure FinTech solutions—launch yours with us today.

IOS

Android

React Native

Flutter

Kotlin

HTML

CSS3

Javascript

AngularJS

ReactJS

NextJs

PHP

Laravel

Node.js

.NET

Figma

Adobe XD

MongoDB

Postgresql

MySQL

SQL Serve

Linux

Window

We provide end-to-end FinTech software development services, including digital lending platforms, mobile banking apps, payment gateways, digital wallets, API banking solutions, WealthTech apps, InsurTech portals, and blockchain-based financial platforms.

Yes. We specialize in building secure and compliant payment solutions, including UPI-enabled apps, QR-based payments, and card-based payment gateways. Our solutions integrate with banking APIs, Bharat BillPay, and Aadhaar-based KYC services, ensuring fast, seamless, and secure transactions for end-users.

Absolutely. We follow bank-grade encryption standards, PCI-DSS compliance, and RBI guidelines to ensure data privacy and fraud prevention. Our platforms include role-based access control, secure APIs, real-time transaction monitoring, and multi-factor authentication (MFA) to protect sensitive financial data.

We design API-first, cloud-native platforms that are scalable, modular, and easily integrable with third-party services. Whether you are launching a FinTech MVP or upgrading an enterprise-grade solution, our platforms support high transaction volumes, multi-currency operations, and regulatory reporting for faster go-to-market and long-term scalability.

Yes. We have expertise in banking API integrations, including NEFT, RTGS, IMPS, UPI, credit bureaus, KYC, and payment gateways. Our solutions support open banking standards, making them ready for financial institutions and aggregators.

Development timelines depend on complexity and features. A basic payment or lending platform can take 10–14 weeks, while a multi-service FinTech ecosystem with integrations may take 16–24 weeks. We follow an agile development process, delivering working modules at every stage instead of waiting for a final release.

Yes. We offer end-to-end support, including maintenance, upgrades, API monitoring, cloud scaling, and compliance updates as financial regulations change. Our solutions are built to grow with your business, ensuring long-term stability and performance.

Unlike generic IT vendors, we specialize in FinTech and understand compliance, data security, and user experience requirements. We build custom solutions that are fast, secure, API-driven, and scalable.

Take a Step towards us and it's our commitment and responsibility to fulfill the requirements mark of the Customer within the Estimated Budget and with Latest technology, with our track records we have ensure that our clients get nothing less than the best.