100% Custom Solutions

Delivered

Unlike off-the-shelf software, we analyze your loan products, approval processes, and customer journey before building solutions.

Specialized in delivering custom IT services and solutions to Non-Banking Financial Companies (NBFCs). Whether you're managing microloans, vehicle finance, or housing credit, our tailored platforms are designed to match your exact processes, helping you digitize operations, enhance customer experiences, and stay compliant with RBI norms. Our experts in fintech, development, and UI/UX work as an extension of your team to deliver technology that adapts and scales with your business.

Years of Experience

Successful Projects

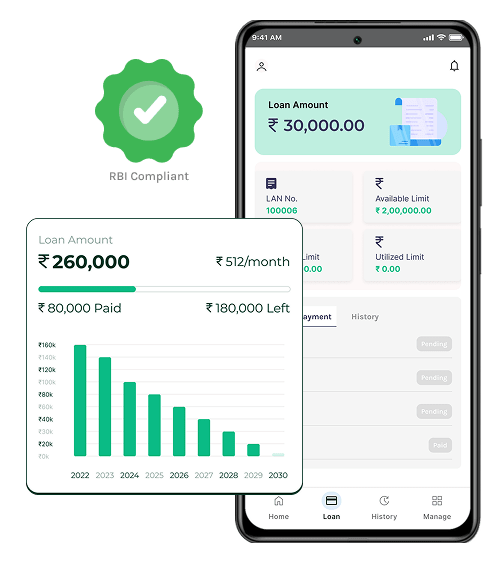

Custom Loan Management System

End-to-end automation of every stage from application, KYC, and credit scoring to disbursement, EMI generation, and closure—reducing manual intervention and accelerating operations.

NBFC CRM Systems

Our CRM for NBFCs helps track leads, manage borrowers, assign tasks to field agents, and streamline customer communication. It empowers teams with real-time dashboards and reporting.

Digital KYC & Document Management

We design secure KYC solutions and document management platforms for NBFCs to collect, verify, and store borrower documents digitally. The system integrates with Aadhaar, PAN, and Digi locker APIs.

Mobile Apps (Borrower & Field Agent)

We build custom mobile applications for borrowers and field agents to enable easy EMI payments, loan tracking, KYC submissions, and on-field data collection, ensuring seamless operations even in remote areas.

Customer Portal & Corporate Website

Our team creates SEO-friendly corporate websites and self-service borrower portals, where customers can track loan status, submit documents, download statements, and raise service requests.

Third-Party API Integrations

We integrate NBFC platforms with Aadhaar, PAN, CIBIL, payment gateways, SMS/Email APIs, and credit bureaus to streamline customer verification, risk assessment, and payment processes.

Compliance & Regulatory Reporting Tools

Our solutions include real-time dashboards, automated reports, and audit logs to simplify RBI compliance, regulatory filings, and internal approvals—reducing the burden of manual compliance tracking.

Cloud Hosting & DevOps

We provide secure cloud infrastructure on AWS and Azure with CI/CD pipelines, backups, and monitoring to ensure scalability, high availability, and 24/7 uptime for mission-critical NBFC applications.

Unlike off-the-shelf software, we analyze your loan products, approval processes, and customer journey before building solutions.

Platforms are designed with end-to-end security, data encryption and, role-based access, ensuring complete RBI-compliant operations.

Platforms are developed with deep knowledge of NBFC operations, lending processes, compliance norms, and RBI guidelines.

Connect effortlessly with credit bureaus, wallets, payment gateways, digital KYC providers, and third-party CRMs using pre-built APIs.

From UI/UX design to development, cloud hosting, integrations, and long-term support, we provide a complete ecosystem for your NBFC.

We don’t just build and leave, we provide AMC, feature enhancements, cloud DevOps, and version upgrades as your NBFC grows.

We deliver modular, customizable NBFC software that meets the needs of Microfinance Institutions, Housing Finance Companies, and consumer lenders. Whether you're scaling operations or digitizing documentation, our platform ensures operational efficiency, compliance, and digital-first user experience.

Get Free Consultation

Loan Management System

Regulatory Compliance Tools

Customer Service Portal

CRM modules for customer engagement

Loan Application System

MIS Reporting dashboard

Corporate Website

Automated KYC & CKYC Verification

Mobile App for Field Agents

Digital Payment Integration

Our approach starts with deep analysis of your processes, followed by building platforms that fit your workflow, not the other way around.

1

2

3

4

5

6

Planning to build a digital lending app or credit management system? Let’s craft your custom NBFC tech solution—book your free consultation today.

IOS

Android

React Native

Flutter

Kotlin

HTML

CSS3

Javascript

AngularJS

ReactJS

NextJs

PHP

Laravel

Node.js

.NET

Figma

Adobe XD

MongoDB

Postgresql

MySQL

SQL Serve

Linux

Window

We offer end-to-end digital solutions for NBFCs, including loan origination systems (LOS), loan management systems (LMS), digital lending platforms, customer onboarding portals, KYC/AML compliance tools, collection management software, and mobile banking apps.

Yes. We specialize in building secure, cloud-based digital lending solutions that automate KYC, credit scoring, loan approval, EMI tracking, and collections. These platforms help NBFCs disburse loans faster, reduce operational costs, and improve customer experience.

Absolutely. We follow RBI guidelines, PCI-DSS compliance, and data privacy regulations to ensure secure and lawful operations. Our platforms include Aadhaar-based e-KYC, credit bureau integrations, fraud detection, and encrypted data handling for maximum security.

Yes. We have expertise in integrating CRIF, CIBIL, Equifax, Experian, as well as payment gateways, UPI, and net banking APIs. Our platforms are API-first and cloud-ready, ensuring seamless connections with banks and financial partners.

Our platforms reduce manual paperwork, speed up loan processing, and provide real-time analytics for better decision-making. By automating key processes—from customer onboarding to collections—we help NBFCs scale faster and serve more customers efficiently.

The timeline depends on scope, features, and integrations. A basic LOS/LMS can be delivered in 10–14 weeks, while a complete lending ecosystem with APIs and mobile apps may take 16–24 weeks. We follow an agile approach, ensuring early deliveries of usable modules.

Yes. We offer complete maintenance, API monitoring, compliance updates, and scalability support even after launch. Our solutions are future-ready, ensuring NBFCs stay updated with regulatory and technological changes.

Take a Step towards us and it's our commitment and responsibility to fulfill the requirements mark of the Customer within the Estimated Budget and with Latest technology, with our track records we have ensure that our clients get nothing less than the best.